FORT PORTAL, UGANDA – In a significant stride towards enhancing insurance as a critical component of financial literacy among Ugandan youth, the Insurance Training College (ITC) has successfully conducted a training workshop for 120 (one hundred twenty) secondary school teachers from the Rwenzori Sub-region. The initiative is a direct response to the new national secondary schools’ curriculum, which for the first time incorporates entrepreneurship education with a dedicated component on insurance.

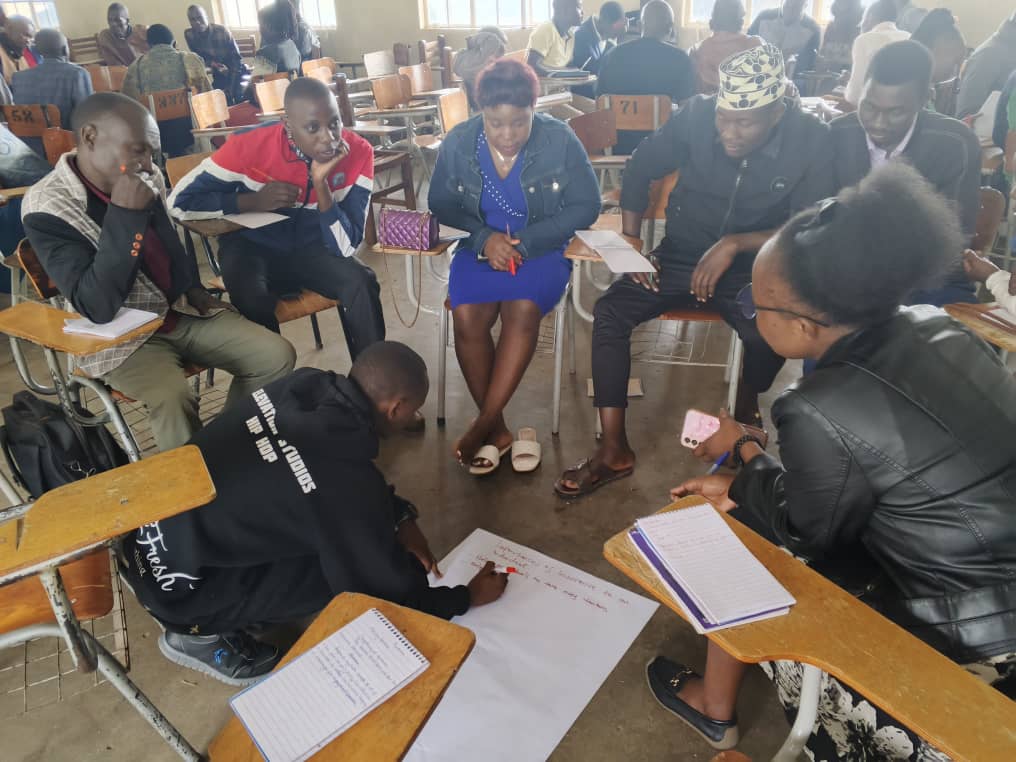

The training, which has already been rolled out in the Eastern Region, focused on equipping educators from across the Rwenzori sub-region with the expertise and confidence to teach insurance-related concepts effectively. Teachers were taken through the fundamentals of risk management, the principles of insurance, the various types of insurance products available, and the critical role insurance plays in personal financial security and business entrepreneurship.

This program is a core part of the ITC’s mandate to develop highly competent human capital for the insurance sector, enhance professionalism, and promote a deeper public appreciation and understanding of insurance in Uganda. By empowering teachers, the College is planting seeds that will grow into a generation that is more financially resilient and aware of the tools available to mitigate risk.

The Principal/CEO Sets the Tone

Before the training commenced, the Chief Executive Officer of the Insurance Training College, Saul Sseremba gave context to the visionary nature of the initiative.

“We are not just launching a training workshop in the Rwenzori sub-region; we are igniting a crucial national conversation. The inclusion of insurance in the secondary school curriculum is a visionary step, recognising that true entrepreneurship cannot thrive without understanding risk.”

He emphasised how teachers are a vital link with the profound responsibility of shaping the minds that will build the businesses and manage the economies of tomorrow.

“We are here to ensure you feel empowered, knowledgeable, and confident in delivering these concepts. This knowledge is not just an exam topic; it is a life skill, a career path, and a business opportunity. It is about protecting a family’s livelihood, securing a farmer’s harvest, and enabling a young innovator to take a calculated risk. ITC is proud to partner with you in this mission. Let us work together to build a more insured, and thus more secure, Uganda,” Saul added.

The training was facilitated by a team of experts from the College, including the Academic Registrar, Dumba Sulaiman and Angellina Nakuya, the Training Manager and who were both present to oversee the proceedings and engage directly with the teachers.

The initiative has been met with positive feedback from the teaching community, who have expressed renewed confidence in tackling the new curriculum and inspiring their students to see insurance not as a complex product, but as an essential pillar of modern life and business.